The world is going through what could possibly be the biggest crisis to date. Meanwhile, the energy sector is facing unprecedented conditions, both political and economic. In these circumstances, with the COVID-19 raging, it seems the oil and gas markets have been the most affected.

With this in mind, one of the World Energy Council’s Future Energy Leaders, Massimiliano Cervo has analysed, three oil stocks, selecting Exxon Mobil (represented with the green colour in chart OIL COMPARISON IMAGE 1), PetroChina (represented with blue colour in chart) and Baker Hughes (represented with orange colour in chart). The period chosen was from 2015 up to the present. The grey area marks the period since the beginning of COVID-19 spreading worldwide. From the straight arrows we can spot the downtrend market.

The chart shows that the oil and gas companies’ downward trend has been happening since 2015 at least, with a medium- average drop of 56% due to COVID-19 and the price struggle between Russia and Saudi Arabia. However, this work will not engage in inferential analysis as the main objective is to recognize a trend which clearly exhibits a price declination.

As financial advisors say, it is better to diversify the invested capital into different resources, instead of putting all the eggs into the same basket. That, for the oil industry, would mean opening new positions in other technologies. If economies are to be reactivated, businesses will need to change.

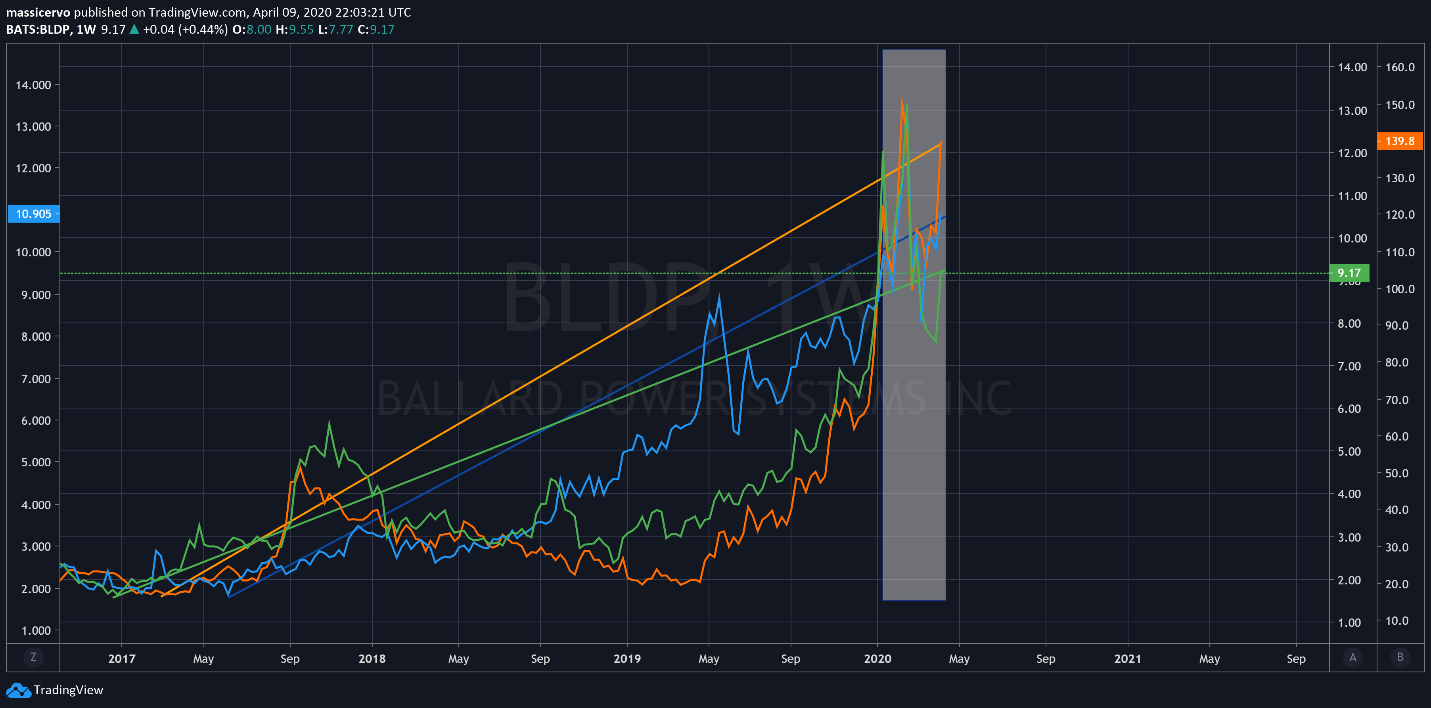

Thinking of other divisions of the energy market, the chart below analyses how companies, that invested in hydrogen, doing in the middle of this crisis. Choosing for this example Ballard (represented with green colour), NEL (represented with blue colour) and ITM (represented with orange).

The chart below, HYDROGEN COMPANIES 2:

The trends are easily spotted with the straight lines indicating an uptrend from 2017 to the present time, with the grey area, as in the chart before, marking the period of COVID-19. Over this period, there was a 36.5% drop on average. That shows that hydrogen technology developers are increasing their share while oil and gas bring uncertainty to the market.

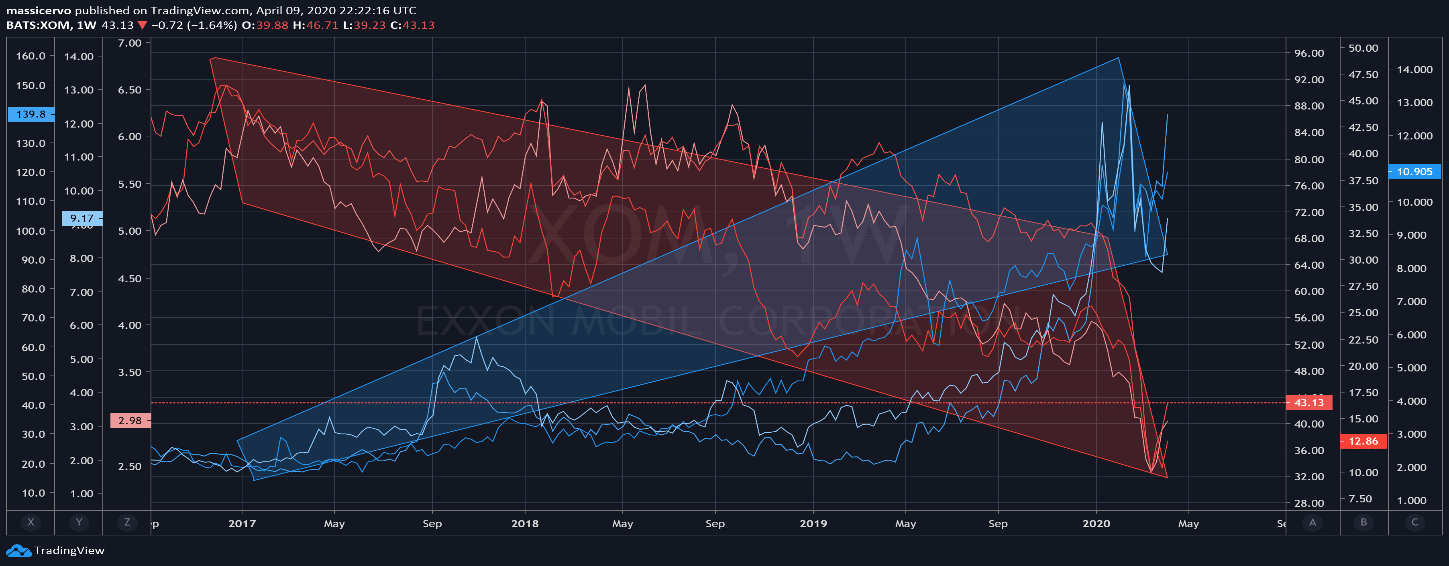

Thinking of ways to make matters clear and to locate turning points in the market, the chart below (OIL AND HYDROGEN 3) directly compares oil and gas companies versus those developing hydrogen technology. It joins all the tickers together in one single graph, using the same companies from the previous exercises with the difference that we chose shades of red for oil and gas companies and tones of blue for companies developing hydrogen technology.

Two areas were created to get a better picture of the situation, the red exhibits downward trend behaviour and the blue an uptrend. Both are still running in opposite directions and both have been affected by the current situation the world is living in. However, the one that has been worst hit is oil and gas.

A decline in short term investment is leading to a new thinking about the future of energy. And while we will need economic recovery, we must put greater emphasis on infrastructure resiliency, energy efficiency and clean innovative technology. This is where hydrogen can present an opportunity for a new period of transitioning. A well-functioning, vibrant economy relies on investment in sustainable and resilient energy.

Policy makers and energy leaders can make the most out of the current situation. One of the drivers being the supply of clean, affordable, and secure energy that can face this kind of crisis at a lower rate of decline. As a result of these measures, countries can preserve and restore ecosystems that will, effectively, accelerate the move to sustainability.

This is a critical time for hydrogen which is progressing through what the down theory of market declares to be the accumulation phase. The market will possibly manage a price correction, but the pace of the hydrogen uptrend is increasing. The next step for hydrogen in this crisis will be crossing the slope of enlightenment to reach the productivity needed.

However, it is apparent that hydrogen is not a silver bullet. It is an enabler of a new way of trading energy, producing clean fuels and decarbonising the high heat sectors such as the metal industry. Green hydrogen could lead to greater investment in the renewables, coupling and integrating sectors.

As an aftereffect, a fall in the CAPEX of hydrogen associated technologies to lead the long term thinking of businesses, political coordination and collaboration to develop a legal framework and instruments that will assist with the integration can be expected. A consideration is that its applications are very diverse, such as feedstock, blending to reduce end emissions, export of clean energy, long term storage of clean energy, among others.

In conclusion, the energy sector presents new opportunities for the major companies to diversify their investments. Short-term action is needed to stabilise the sector, continue to incentivise energy solutions, and restore the long-term confidence of investors. The sector has been presented with an opportunity ahead of conventional, that could revert the downtrend they are facing. This moment should be used as a turning point for a better and cleaner future.

Contact: Massimiliano Cervo, Future Energy Leader, World Energy Council